IR35

These rules were created to combat what it saw as widespread avoidance of tax and NICs by disguised employees. Its sometimes called intermediaries legislation because it involves an employer hiring a worker through a third party.

Key Facts About Ir35

It was introduced to combat the problem of disguised employment.

. The calculator assumes you work 5 days per week 44 weeks per year. The IR35 reform will be repealed from April 6 2023 according to this mornings mini-Budget. Speaking to the House of Commons today September 23 Chancellor Kwasi.

The rules were inspired by the finding that only 10. The legislation is contained within Chapter 8. IR35 was introduced in 2000 and the IR35 rules became law via the Finance Act 2000.

IR35 is a piece of tax legislation designed to stop companies from employing contractors as disguised employees. How to use the IR35 calculator. A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties.

HM Revenue and Customs HMRC introduced the intermediaries legislation which became known as IR35 in the 2000 budget to combat disguised employees. With some individuals providing their services through one of these structures the responsibility falls on the end user or client. The off-payroll working rules apply on a contract-by-contract basis.

Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a company in. September 23 2022 134 pm. IR35 legislation is a set of rules that ensures those who work as employees but through their own limited companies or personal service company PSC pay a comparable level of income tax as those employed directly.

If it was not for their limited company they would. The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to. IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the.

The repeal of the off-payroll rules often referred to as IR35 represents a significant change in direction from the government. We use some essential cookies to make this website work. IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000.

IR35 is a piece of legislation which allows HMRC to treat private contractors as if they were employees. What does IR stand for in IR35. The original press release outlining the details was called IR35.

Read this guide to find. The definition of small business for IR35 exemptions is likely to be based on the definition in the Companies Act which is met if a company meets any two of the three triggers below. The IR stands for Inland Revenue and.

What Is the IR35 Legislation. List of information about off-payroll working IR35. Fill in the yellow boxes to calculate your net income inside and outside IR35.

IR35 refers to tax legislation which aims to prevent workers avoiding tax by working as contractors via a service company when they are really employees. From 6 April 2021 clients will need to determine the employment status of a consultant every time they agree to a contract with a consultant or agency for services. The term refers to individuals using a limited company to provide their services that pass the employment tests.

While IR35 had previously been present within the. The term IR35 refers to the press release that originally announced the legislation in 1999. IR35 has become the nickname for HMRCs off-payroll working rules that are part of the Finance Act.

There is a set of specific criteria that HMRC uses to decide whether or not a contractor is an employee based on case law from previous rulingsA basic rule of thumb is that if the working relationship would remain the same if the intermediary limited company for example was removed then the contract falls under IR35The following three criteria are. Wed like to set additional cookies to understand how you use GOVUK. In response to the huge growth in numbers of so-called personal services companies the Government implemented the Intermediaries Legislation IR35 with effect from April 6th 2000.

What Is Ir35 Ir35 Explained For Contractors And Freelancers

Zsrbui1mtvrtim

How Ir35 In The Private Sector Could Impact Your Business

Ir35 Reforms Scrapped In Mini Budget Inniaccounts

The Most Asked Questions About Ir35 Markel Direct Uk

Vj7jhn8skapanm

Ir35 Insurance Roots Contractor Insurance

A Guide To Ir35 Legislation Global Employment Bureau

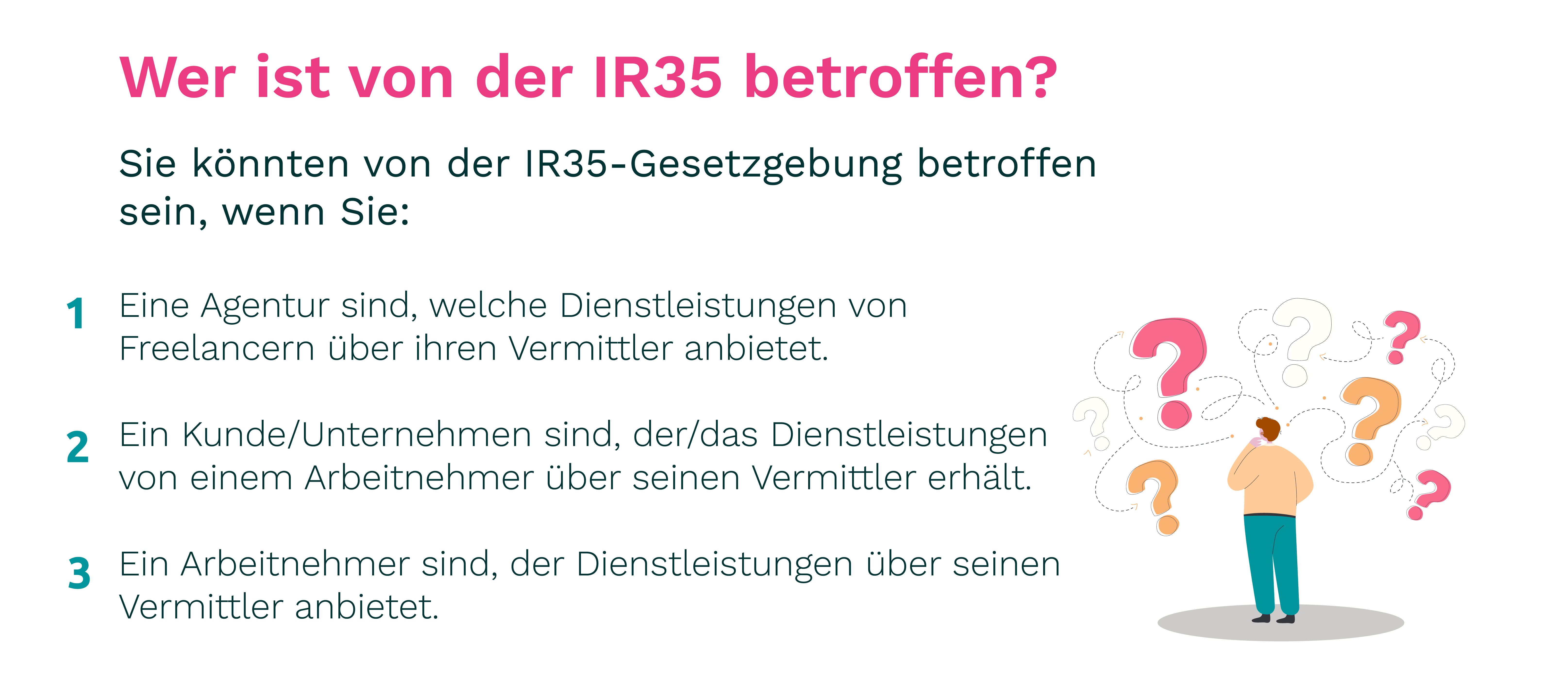

Ir35 Was Ihr Unternehmen Wissen Sollte Workmotion

Ir35 Guide For Employers In Architecture

What You Need To Know About The Uk Ir35 Rules Goglobal

Ir35 Manpowergroup

What Is Ir35 And Does It Apply To You Checkatrade

Nf Dpyit09hhmm

Ir35 What It Means To Freelancers And Self Employed Beb

What Is Ir35 Ir35 Explained For Contractors Totaljobs

The Ir35 Changes Are Here What Does It Mean For You Rouse Partners Award Winning Chartered Accountants In Buckinghamshire